Inflation & Defaults On The Rise

Economic Update

U.S. manufacturing broke its 16 consecutive months of contraction with March increasing by 2.5% to settle at 50.3%. The unemployment rate remains relatively unchanged at 3.8%, adding over 300,000 jobs, well above economists’ estimates. Furthermore, inflation for March was up 0.3% climbing to 3.5% from a year earlier and core prices all rose by 0.4% for a second straight month. This news will complicate the Feds duty as they will have to reevaluate monetary policies. Rate cuts are looking less likely as rate hikes could be back on the table due to strong and resilient economic sentiment.

Insolvencies

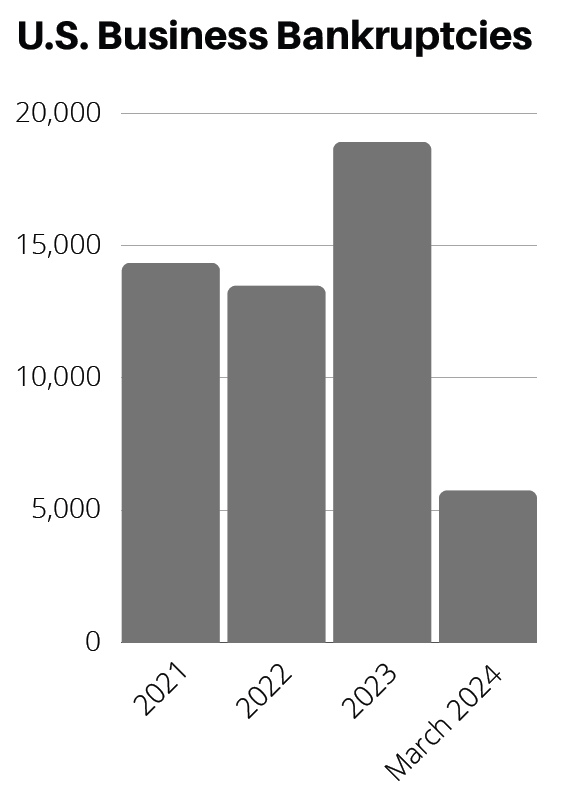

The first quarter of 2024 had increases in all filing classes year over year adding to its streak of 20 consecutive months. Total overall commercial bankruptcy filings increased by 22% when compared to the prior quarter and small businesses grew by 30% in the same timeframe. We note that 77% of small businesses are concerned with having access to liquid funds and 28% found available options were predatory or unfavorable. Factors contributing to insolvencies gaining steam and accelerating are elevated rates, higher borrowing costs, and weakening consumer spending all negatively impacting organizations.

State of Corporate Credit

April looks to be the busiest month for defaults and is on pace to topple 2009 pace. To put this current year’s pace in perspective, the defaults for the first two months are the most since the Great Recession. The default for the current quarter is up 43% when compared to last year and its expected that defaults will peak the last few months of the year. We are noticing elevated trade payment risk as companies report slower payment habits from customers as missed payments are becoming an increasingly common reason to default.

Current & Evolving Credit Risks

Zombie Companies

Debt maturities for 2023 and 2024 have pushed out a large chunk of debt until 2028 as maturities grew by 44%. These companies have no intention of paying off debt and are focused on servicing it, which is a concern as they are not solving the main problem. Typically, these companies have weak credit characteristics with similar traits like limited access to capital and high financing costs.

Fragile Borrowers

The private credit market has rapidly grown over the year and raises several vulnerabilities. Typically, private credit has variable or floating rates putting them in jeopardy during downturns or rate hikes. Furthermore, weak entities participate in this market as they have trouble securing or qualifying from banks, so they look to other financial institutions. Lastly, the biggest issue is the lack of financial transparency, which proves tricky to track credit risk characteristics, but the consensus is the majority are highly leveraged.

Repeat Defaulters

The percentage of companies that have defaulted on their debt more than once has reached its second highest level since 2008, according to a new report from S&P Global Ratings. Around 35 per cent of total global defaults in 2023 were by issuers that are “re-defaulters.” The uptick in re-defaults comes as more and more borrowers opt to undergo distressed exchanges, which are agreements that deal losses to creditors and help companies avoid bankruptcy. We note this only provides a temporary fix and doesn’t necessarily address problematic capital structures. This is why reviewing a company’s credit character and default history is crucial when making a credit decision.