Increase in Bankruptcies Tied to Increase in Junk-Rated Borrowers

Economic Update

In June, the US manufacturing rate was 48.5% dropping by 0.2% from the previous month, marking three months of contraction. June also saw the unemployment rate rise to 4.1%, the highest it has been since 2020. However, inflation dropped to 3.0%, down by 0.1%, continuing its slow decline. This news will come as a relief to the Fed, however, more evidence will be needed before any rate cuts.

State of Corporate Credit

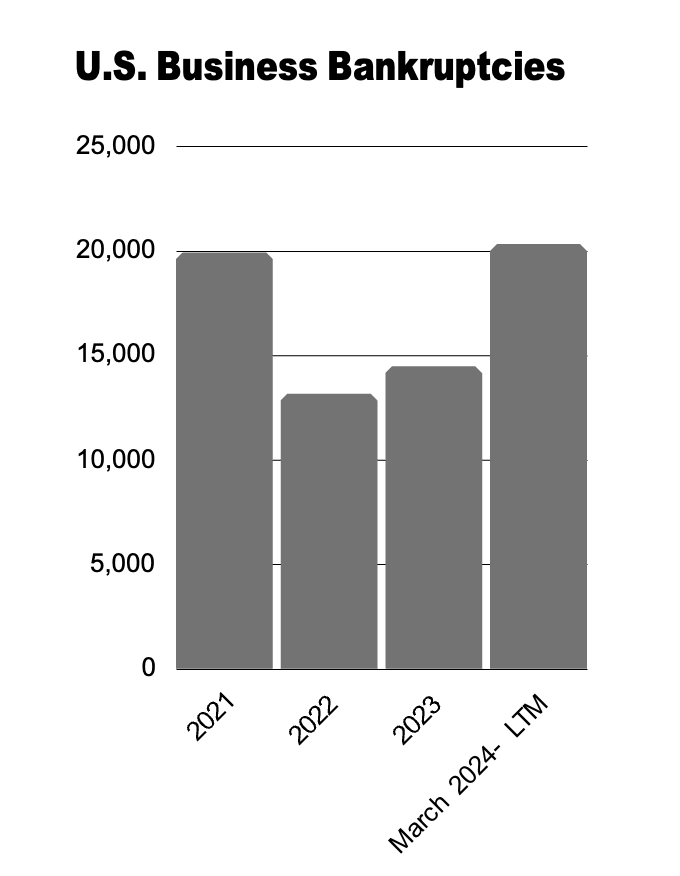

Corporate credit risk remains elevated but is stabilizing except among low-rated entities where volatility persists. We expect bankruptcies to gradually decline more in line with long-term averages as we approach 2025 and beyond. However, this could be upended depending on economic growth and interest rate actions. Over the past two years, many companies have chosen to refinance their term debt and lines of credit at higher interest costs. This trend continues to pressure cash flow, liquidity, and profitability.

Insolvencies

Overall, the first half of 2024 data shows commercial chapter 11 filings increased by 34% and small business filings stayed elevated at 61%. Filings continue to show strong double-digit increases year over year. We note increased costs, elevated rates, and heightened geopolitical tensions as culprits for continued double-digit gains.

Current & Evolving Credit Risks

Interest Coverage Ratio

Leveraged loans had an average of 3.1x EBITDA/Interest in 2024, which is the lowest reading since 2007. Additionally, we note the average debt/EBITDA is at 4.7x up from last year at 4.5x. Loan risk appetite has come back swiftly with Q2 reaching a record high for B- rated entities and leveraged loan demand is on a record pace.

Private Debt

Seeking new investments that are typically dominated by banks and government bonds is the new trend in private debt. The targets for private debt are focused on infrastructure projects and investment-grade rated entities. Borrowers will rejoice in this opportunity as it’s less cumbersome and less regulated, but the credit concern is lack of transparency. As these private debtors become more involved this can impact the ability to evaluate creditworthiness.

Junk Rated Entities

Although upgrades have surpassed downgrades this is tied to most becoming insolvent and the concern is tied to B-/CCC/C rated borrowers. Weakness plagues these borrowers as they continue to increase over the last few months from the start of the year until May. In June alone, ten issuers were downgraded to B- or lower, which was the most in 2024 signaling a struggling credit environment for the most vulnerable.