Credit Headwinds Continue As Economy Holds Steady

Economic Update

U.S. manufacturing continued to decline, with May representing a 0.5% decrease from April. Despite soft demand, stable output has helped the overall economy continue expanding for the 49th consecutive month. In May, unemployment remained steady at 4% and non-farm employment increased by 272,000 jobs, a higher-than-average monthly gain. Core inflation continued its slowdown to 3.4% from 3.6% and total inflation to 3.3% from 3.4% year over year. The FED will likely start reducing rates with one cut toward the end of the year and possibly two, but this is not guaranteed and will be a close call.

State of Corporate Credit

Credit risk remains elevated in the industrial sector as volatility plays out. Credit metrics, including interest coverage for some, remain strained as interest expense mounts and profitability declines. In the first quarter of 2024, credit insurance claims data from one of the largest insurers indicate a 27% increase in dollar amount and a 42% by volume year over year. This is indicative that several sectors remain under pressure including chemicals, transportation, energy, metals, and paper among others.

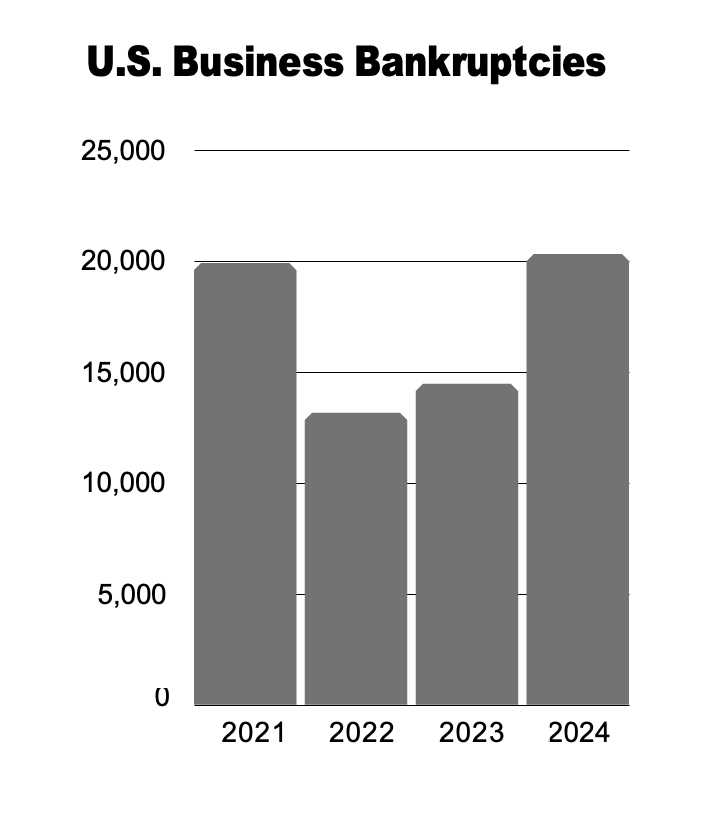

Insolvencies

Bankruptcy filings continued to rise in May with total filings up 16% over May of 2023. Chapter 11 filings increased 11% over the prior year period, and Subchapter V filings were up a significant 53% over May 2023. The upward trend demonstrates the strain that higher interest rates, operating expenses, and slower growth are putting on businesses. A positive note is that May’s total filings were down 3% over April of this year.

Current & Evolving Credit Risks

Sporadic Payment Declines

We are seeing payment stretching tick up for some. The reasons seem to run the gambit from bank refinancings to tight liquidity and weaker cash flow.

Loan Losses

In May many US banks reported lower-than-expected loss provisions despite higher for longer rate expectations. This is a sign of resilience while credit losses are currently manageable. Loan defaults could accelerate depending on the duration of the current rate environment.

Corporate Debt

Of the $1.2 Trillion in rated debt, 80% is rated B- or lower and comes due through 2028. This group has the highest negative outlook bias right now according to S&P.